Tutorial: Analyzing a model

This Tutorial page shows you how to:

- Perform importance analysis

- Perform parametric analysis

- Set up and compare alternative decisions

In this Tutorial you will analyze the Rent vs. Buy Analysis model, a modified version of the model that you used in Tutorial: Open a model to browse and Tutorial: Reviewing a model. You will identify its key sources of uncertainty through importance analysis, perform parametric analysis, and compare alternative decisions.

For instructions on how to open a model, see “Opening the Rent vs. Buy model”. In this case, however, open the Rent vs. Buy Analysis model by double-clicking the file labeled Rent vs. Buy Analysis.ana.

Tutorial Video: Analyze a model (6 minutes)

Examine the difference between renting and buying

The Rent vs. Buy Analysis model is the module called Model that you explored in Tutorial: Reviewing a model with the addition of nodes to help you understand the importance of the uncertain inputs to the uncertainty in the output.

In Tutorial: Open a model to browse you saw that evaluating Costs of buying and renting produces a graph of two uncertain values. To understand whether it would be financially advantageous to rent or buy, the Rent vs. Buy Analysis model includes the objective node, Difference between buying and renting.

The difference between the two uncertain values is also uncertain. The difference is positive if buying costs less over the time period, and negative if renting costs less over the time period.

Importance analysis

In the Rent vs. Buy Analysis model, as in most complex models, several of the input variables are uncertain.

It is often useful to understand how much each uncertain input contributes to the uncertainty in the output. Typically, a few key uncertain inputs are responsible for the lion’s share of the uncertainty in the output, while the rest of the inputs have little impact.

Analytica’s importance analysis features can help you understand which uncertain inputs contribute most to the uncertainty in the output. You can then concentrate on getting more precise estimates or building a more detailed model for the one or two most “important” inputs.

Analytica defines importance as the rank order correlation between the output value and each uncertain input. Each variable’s importance is calculated on a relative scale from 0 to 1. An importance value of 0 indicates that the uncertain input variable has no effect on the uncertainty in the output. A value of 1 implies total correlation, where all of the uncertainty in the output is due to the uncertainty of a single input.

It is clear in the figure above that the input Appreciation Rate is contributing most of the uncertainty in the Difference between buying and renting.

For more information about importance analysis and the steps to create an importance variable in your own model, see Scatter plots in the Statistics, Sensitivity, and Uncertainty Analysis chapter of the Analytica User Guide.

Perform parametric (sensitivity) analysis

Parametric analysis (also called sensitivity analysis) involves varying the value of an input variable to examine its effect on a selected output. Performing sensitivity analysis often provides useful insights into how small changes in input variable values affect the desired outcome.

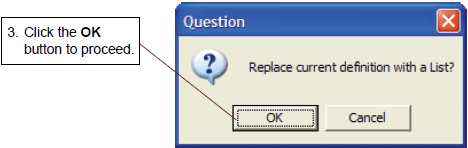

Because the importance analysis in the section “Importance analysis” revealed that Appreciation rate caused most of the uncertainty in Difference between buying and renting, you will start the parametric analysis with that input variable. You will change Appreciation rate’s definition from a probability distribution to a list of alternative values, and analyze the effect on the Difference between buying and renting output.

Before proceeding, click the edit button ![]() in the toolbar to switch into edit mode. In edit mode you can modify the model: adding and removing nodes, and modifying existing nodes. Then click the key icon

in the toolbar to switch into edit mode. In edit mode you can modify the model: adding and removing nodes, and modifying existing nodes. Then click the key icon ![]() to open the Attribute panel, then select the Appreciation rate node, and then select Definition from the Attribute dropdown menu to view its definition.

to open the Attribute panel, then select the Appreciation rate node, and then select Definition from the Attribute dropdown menu to view its definition.

When the Definition attribute is displayed, the Expression popup menu ![]() appears.

appears.

Before proceeding, click the edit tool ![]() to switch to edit mode.

to switch to edit mode.

The Expression popup menu allows you to change the definition of a variable to one of several different types of expressions.

Expression types include:

You will now use the Expression popup menu to change the definition of Appreciation rate from a probability distribution to a list. You will redefine Appreciation rate as a list of alternative values from -10% to 10%.

Note that the icon on the Expression popup menu changes to indicate that List ![]() is selected.

is selected.

When a definition is first changed to a list, a cell (indicated by a box around it) appears in the definition. The first cell in the list initially contains the expression that was previously in the definition. In this case, you see the expression for a normal distribution (Normal(Inflation,3)).

You will replace the entry with a number and add cells to perform parametric analysis.

A new cell appears with the value -9. Change its value to -5. After you have entered two values, as you press Enter to add a new cell, Analytica automatically fills in the new cell with a value based on the difference between the last two values. You can override the automatic value by typing the desired value.

Pivot the graph as follows:

The resulting graph shows the mid value of buying and renting as a function of Appreciation rate, which varies from -10% to 10%, as you just entered.

Appreciation rate is informally called an index because it characterizes a dimension of another variable’s value, in this case, Costs of buying and renting.

The graph shows that at an Appreciation rate of about -5% per year, renting and buying costs the same. If it is less than -5%, it would be better to rent; if it is greater than -5%, it would be better to buy.

The table shows the values computed for each parameterized value of Appreciation rate.

Evaluate alternative decisions

Analytica allows you to perform sensitivity analysis on several variables simultaneously.

In this section, you will change Buying price to compare results based on alternative decisions. In doing so, you will perform parametric analysis on both Buying price and Appreciation rate at the same time.

The first cell in this list contains the expression for the previous definition, 140K. You will change this value, and add additional cells, as you did in previous steps.

The Result window appears displaying the variable’s mid value. The Difference between buying and renting variable is three curves, one for each Buying price. Below the graph is a key to identify each curve.

When you examine the mid value results, you can see that only a $160K home, coupled with an appreciation rate of -2%/year or less, or a $140K home, coupled with an appreciation rate of -6%/year or less, results in renting being cheaper than buying. So, what is the best buy, a 120K home or a 160K home? That depends on what you anticipate the appreciation rate will be. For appreciation rates less than 9% per year, the less expensive home is the better investment. For higher appreciation rates above 9%, the more expensive home provides a larger return.

Remember that the cost of renting has been held constant. To further investigate the effect of this, you will examine the Costs of renting and buying node.

The result has three dimensions, Buying price, Buy or rent, and Appreciation rate, shown in the figure above.

Because only two dimensions can be shown in the graph, Analytica chooses one value of the third dimension to display, in this case, Buying price equals $120K.

Use the navigating arrows to display different values of the Buying price index.

The graph changes to show the mid value of Costs of buying and renting given that the Buying price equals $160K.

This table shows the mid value cost of buying for the parameterized values of Buying Price and Appreciation Rate.

This table shows that Cost to Rent does not vary with Buying Price or Appreciation rate.

Summary

In this chapter, you have:

- Performed importance analysis.

- Performed parametric analysis.

- Set up and compared alternative decisions.

The next chapter introduces you to creating a new Analytica model.

You can quit Analytica at this point.

See Also

- Play the Rent vs. Buy model in Analytica Cloud Player

- Analyzing a model (en explanatory video on YouTube)

- Example Models

- Example Models and Libraries

- Comparing results

- Importance analysis

- Parametric analysis

- Statistics, Sensitivity, and Uncertainty Analysis

- Sensitivity analysis functions

- The Sensitivity Analysis Library

- Tornado Plots

- Tutorial videos

Enable comment auto-refresher