Difference between revisions of "IPmt"

m (→See Also) |

|||

| Line 29: | Line 29: | ||

= Examples = | = Examples = | ||

| − | You have a 30-year fixed-rate mortgage at 6.5% on an initial loan amount of $350K. You have held the mortgage for 5 years -- your next payment will be the | + | You have a 30-year fixed-rate mortgage at 6.5% on an initial loan amount of $350K. You have held the mortgage for 5 years -- your next payment will be the 61th payment. How much of your current monthly payment goes towards interest? |

| − | :-IPmt(6.5%/12, | + | :-IPmt(6.5%/12,61, 30*12,$350K) → $1774.71 |

As a percent of the monthly payment: | As a percent of the monthly payment: | ||

| − | :IPmt(6.5%/12, | + | :IPmt(6.5%/12,61,30*12,$350K) / [[Pmt]](6.5%/12,30*12,$350K) → 80% |

| + | |||

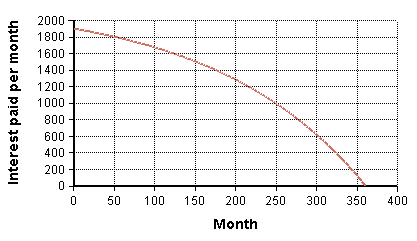

| + | Create a graph of interest paid each month during the life time of the loan. | ||

| + | |||

| + | :Index Month := 1..30*12 | ||

| + | :-IPmt(6.5%/12,Month,30*12,$350K) → [[Image:Ipmt per month.png]] | ||

= See Also = | = See Also = | ||

Revision as of 23:05, 24 September 2009

IPmt(rate,per,nper,pv,fv,type)

Returns the interest portion of a payment received on an annuity, assuming constant periodic payments and a fixed interest rate.

Parameters:

Rate: The interest rate per period.

Per: The period to compute the principal payment for. {1..NPer}

NPer: The total number of periods in the annity's lifetime.

Pv: The present value. If you receive a loan, this is the

loan amount as a positive number. If you give someone

a loan, this is a negative number.

Fv: (Optional) Future value of annuity at the end of the NPer

periods. If you receive a loan, this is your final balloon

payment at the end as a negative number. If you get money

back at the end, this is a positive number.

Type: (Optional) Indicates whether payments are at the beginning of the

period.

True = Payments due at beginning of period, with first payment

due immediately.

False = Payments due at end of period. (default)

Library

Financial Functions

Examples

You have a 30-year fixed-rate mortgage at 6.5% on an initial loan amount of $350K. You have held the mortgage for 5 years -- your next payment will be the 61th payment. How much of your current monthly payment goes towards interest?

- -IPmt(6.5%/12,61, 30*12,$350K) → $1774.71

As a percent of the monthly payment:

- IPmt(6.5%/12,61,30*12,$350K) / Pmt(6.5%/12,30*12,$350K) → 80%

Create a graph of interest paid each month during the life time of the loan.

See Also

Comments

Enable comment auto-refresher