Tutorial: Open a model to browse

This chapter shows you how to:

- Open an existing model

- Calculate results

- Change input values to calculate different results

In this chapter, you use the Rent vs. Buy model, an Analytica model that compares the cost of renting a house to the cost of buying one. After working through the chapter, you will know how to open an existing model, use it to calculate results, and change input values to calculate different results.

Opening the Rent vs. Buy model

To begin, follow these steps.

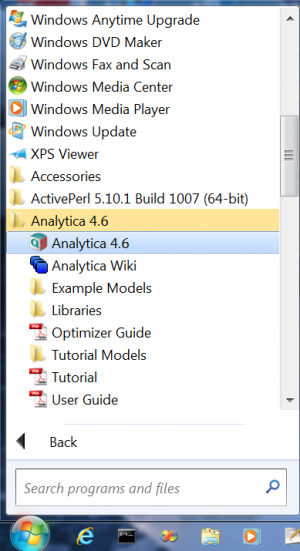

- Launch Analytica: Click the Start button on the Windows taskbar. Click All Programs → Analytica 4.6 → Analytica 4.6.

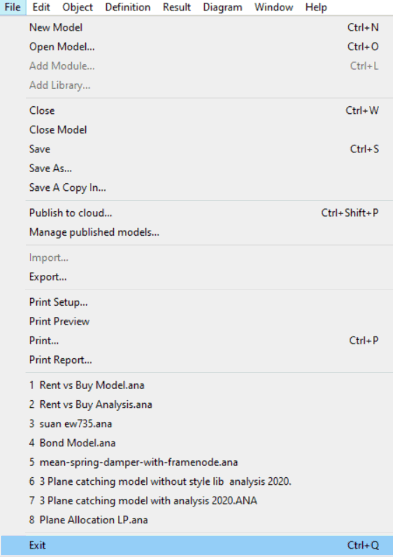

- After Analytica starts, select File → Open from the menu.

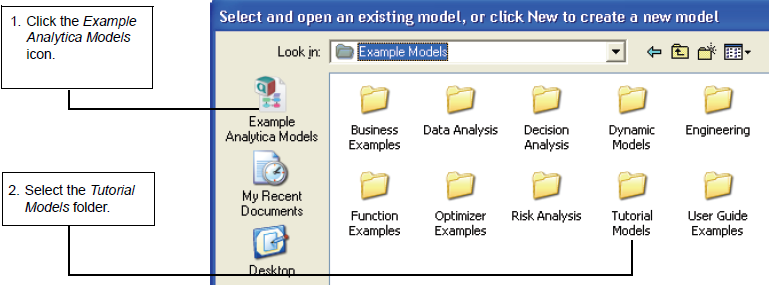

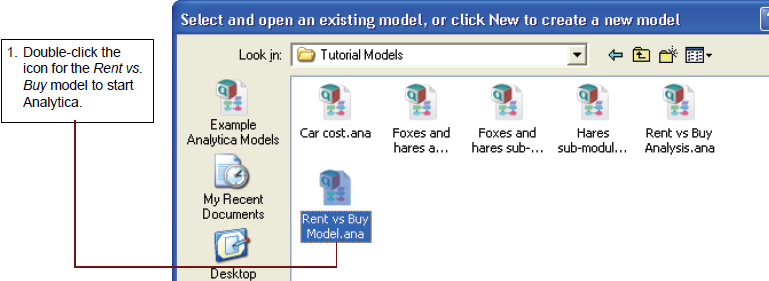

- Open the Rent vs. Buy model.

Analytica reads in the Rent vs. Buy model.

Becoming familiar with the Diagram window

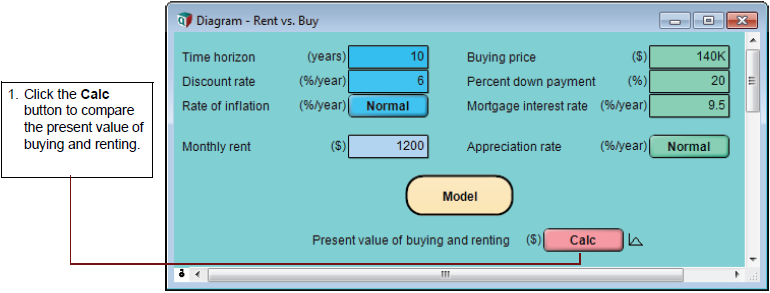

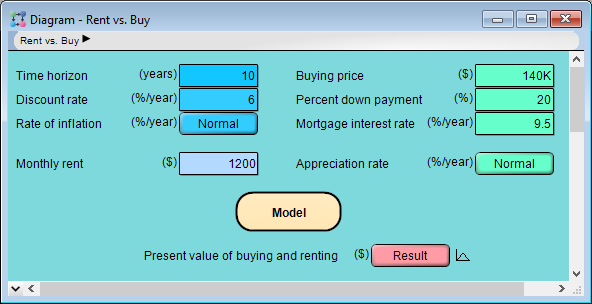

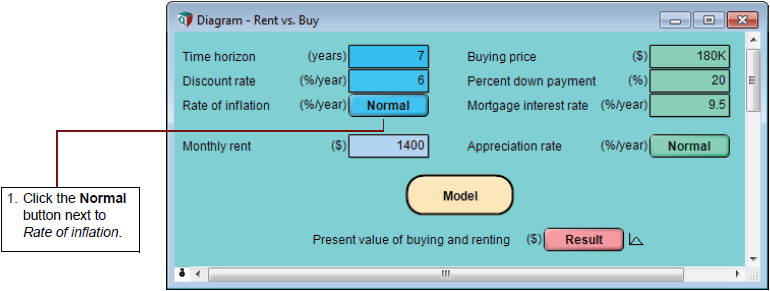

When you open a model, Analytica first displays a top-level Diagram window. The Rent vs. Buy model diagram shows several input variables that affect the trade-offs between renting and buying, Normal buttons, a Calc button, and a node labeled Model.

This top-level diagram is an end-user interface to the model itself, which is contained in the Model node. In this chapter, you use only the interface in this top level diagram; in the following chapters you will explore the model in more depth.

Across the top of the screen is a horizontal palette of buttons. This is called the tools palette.

When you first open the Rent vs. Buy model, the browse tool is highlighted on the palette. With the browse tool selected, the cursor looks like a hand ![]() when it is over the diagram. The browse tool allows you to calculate the model, change input values, and examine — but not change — the structure of the model. In this chapter, you only use the browse tool.

when it is over the diagram. The browse tool allows you to calculate the model, change input values, and examine — but not change — the structure of the model. In this chapter, you only use the browse tool.

Accessing Help Resources

At any time, you can press the F1 key on the keyboard or use the Help pull-down menu to access Analytica’s help resources. These include User Guide and Tutorial documents as well as Analytica’s online Wiki pages.

Computing output values

In the Rent vs. Buy model, the output value of interest is at the bottom, Present value of buying and renting.

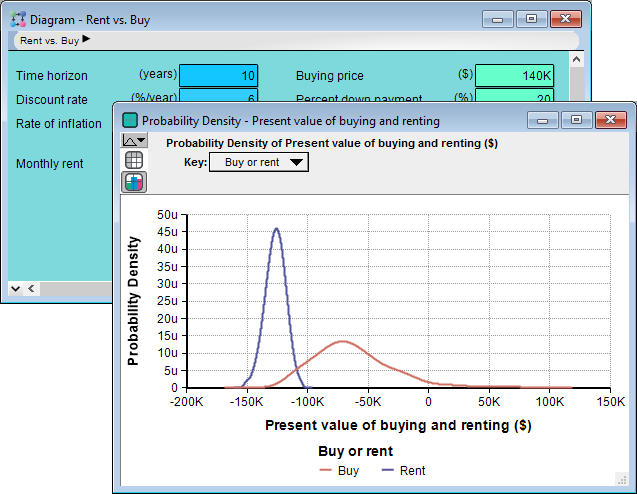

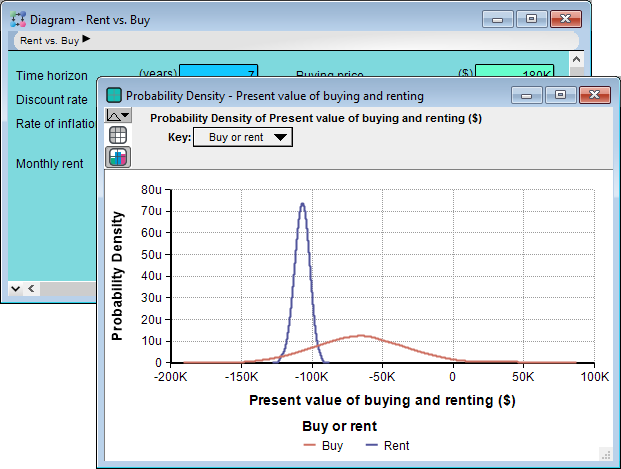

The output value displays in a Result window. This Result window shows a graph of two probability density curves, one for buying and one for renting. In a probability density graph, the units of the vertical scale are chosen so that the total area under each curve is 1 (100%). 25μ corresponds to 25 x 10-6 or 0.000025.

Since the graph is of probability densities, both buying and renting have probabilistic, or uncertain, inputs. The probability density graph for each appear to be bell-shaped curves (normal distribution), although they appear a bit “noisy.”

The graphs show that the cost of renting, given the model’s inputs, are between about $105,000 and $155,000 (the negative numbers mean cost — cash flowing out), while the cost of buying is between $115,000 and a gain of $75,000.

Note: Your results can vary slightly, since the model is generating random inputs based on a normal distribution for the uncertainty of the rate of inflation and for the appreciation rate.

Click the model Diagram window to bring it to the front. Notice that the button next to Costs of buying and renting has changed to Result. The Result button indicates that the value has been computed; clicking the Result button re-displays the computed values.

Changing input values and recomputing

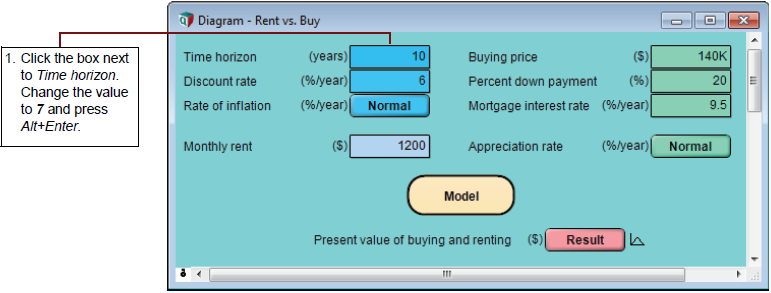

Now you will change some input values to the model and recompute the rent vs. buy comparison. You will change the values of Time horizon, Monthly rent, and Buying price.

The main Enter key and the numeric keypad Enter key are not interchangeable. They have different functions in Analytica. Alt+Enter is equivalent to the numeric keypad Enter key.

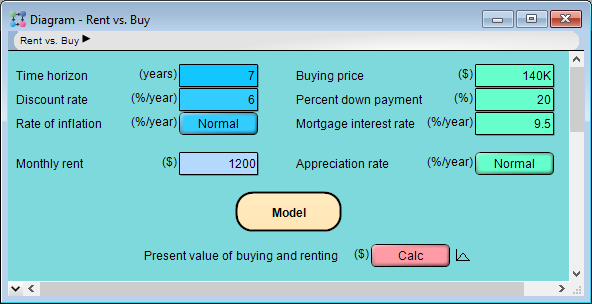

As soon as you change an input, the Result button changes to a Calc button, indicating that Present value of buying and renting needs to be recomputed.

Now you are ready to recompute to see the new results.

The graphs show that the cost of renting, given these changed inputs, is between $90,000 and $120,000, while the cost of buying is between $135,000 and a gain of $70,000.

Examining and changing uncertain input

When an input is defined as a probability distribution, a button with the name of the distribution appears next to the input’s name. Clicking this button opens the Object Finder window, in which you can see details and change the distribution’s parameters or type of distribution.

Rate of inflation’s button says Normal, indicating that it is defined as a normal distribution.

The Object Finder window appears. It shows that Rate of inflation is defined as a normal distribution with a mean of 3.5 and a standard deviation of 1.3.

You will now modify the probability distribution that defines Rate of inflation. Rather than using the normal distribution, you will use the uniform distribution, and assume that inflation has an equal probability of being anywhere between 3% and 4% per year.

The graphs show that the uncertainty in the cost of renting has narrowed to between about $105,000 and $109,000, while the uncertainty in the cost of buying has flattened to between about $125,000 and a gain of $10,000.

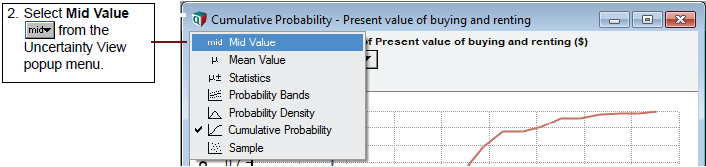

Displaying alternative uncertain views

Analytica offers a variety of views to display uncertain values, including selected statistics, probability bands, the probability density function, the cumulative probability distribution function, measures of central tendency, and the table of random numbers from which the uncertain distribution is estimated.

You will now examine several of these views.

In the upper-left corner of the Result window is the Uncertainty View popup menu.

The miniature probability distribution ![]() indicates that Probability Density is selected.

indicates that Probability Density is selected.

The Result window now shows two cumulative probability curves. Along the vertical axis, these curves give the probability that each cost is less than a given value along the horizontal axis.

There appears to be about a 50% probability that the cost to buy is below $70,000, while the cost to rent has a 50% probability of being below about $110,000.

Sometimes you might want to see an uncertain value expressed as a single number — a measure of central tendency. Analytica computes the mid value (sometimes called the deterministic value) by fixing all input probability distributions at their median (50% probability) values. The mid value is the only uncertainty view available for nonprobabilistic results.

The Result window now displays bar graphs for the two mid values.

Under the Uncertainty View popup menu are two buttons, ![]() and

and ![]() . The

. The ![]() is highlighted, indicating that the Result window is displaying a graph view. The Result window can also display numeric values in a spreadsheet-like table view.

is highlighted, indicating that the Result window is displaying a graph view. The Result window can also display numeric values in a spreadsheet-like table view.

Analytica also provides the mean (or average) value.

You can also view a set of statistics, including both the median and mean, the ranges (minimum and maximum), and the standard deviation.

The Result window now displays the minimum, median, mean, maximum, and standard deviation for Costs of buying and renting. Note that the median value is slightly different from the mid value. The mid value is composed of non- probabilistic results generated by using the mean value for each input. The median value is calculated using probabilistic inputs and taking the median of the resulting distribution.

The statistics might not be exact, because they are estimated from a sample of values from the distribution.

Finally, you see the sample values.

The table above lists the 100 sample values that Analytica randomly generated from the probability distribution to estimate the statistics.

A sample size of 100 is adequate for most applications; however, if you need more precise estimates, you can increase the sample size. See “Uncertainty Setup dialog box” in Chapter 13 of the Analytica User Guide.

Summary

You have now used the Rent vs. Buy model to calculate the results of a model, change input values and probability distributions, and display the uncertain results in a variety of ways. These are the basic techniques for using any quantitative model.

After you create your own models, you might want to give them a top-level input and output diagram like the one used in this chapter. For information about customizing a model for end users, see the Analytica User Guide, Chapter 9.

In the next chapter, you will navigate the details of the Rent vs. Buy model, exploring its structure and contents.

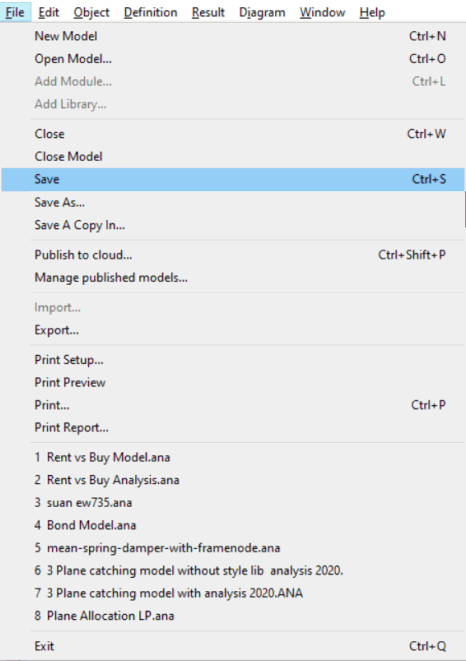

Saving your model

If you want to save changes to your model, you can do so at this point. (For instructions on quitting without saving, see the next section.

If you wish to save your model as a different file, so that you do not change the original model, select Save As from the File menu.

Quitting Analytica

When you have finished using a model, you might want to quit Analytica.

See Also

| About Analytica <- | Using the Rent vs. Buy Model | -> Exploring the Rent vs. Buy Model |

Enable comment auto-refresher