Difference between revisions of "Tax bracket interpolation"

(Created page with "<center>Image:Tax bracket interpolation.png</center> '''Description:''' Computes amount of tax due from taxable income for a 2017 US Federal tax return. To match the IRS'...") |

|||

| Line 1: | Line 1: | ||

| + | [[Category: Examples]] | ||

| + | === Example model === | ||

| + | |||

<center>[[Image:Tax bracket interpolation.png]]</center> | <center>[[Image:Tax bracket interpolation.png]]</center> | ||

Latest revision as of 08:24, 17 January 2023

Example model

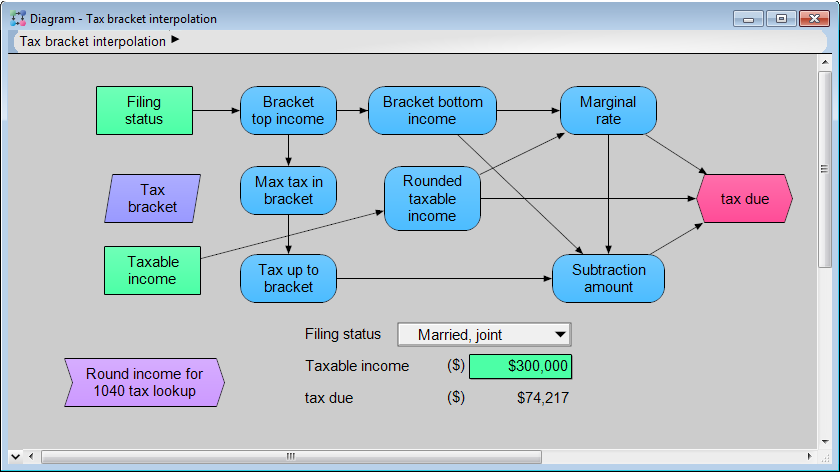

Description: Computes amount of tax due from taxable income for a 2017 US Federal tax return. To match the IRS's numbers exactly, it is necessary to process tax brackets correctly as well as implementation a complex mix of rounding rules that reproduce the 12 pages of table lookups from the Form 1040 instructions. This model is showcased in a blog article, How to simplify the IRS Tax Tables.

Author: Lonnie Chrisman, Lumina Decision Systems

Download: Tax bracket interpolation 2021.ana

Comments

Enable comment auto-refresher