Portfolio optimization with dependencies

This model shows an example of how you can use Optimizer to select the optimal mix of projects for a portfolio that maximize total value subject to each project's costs and dependencies on other projects.

ACP version:

Download: media:PortfolioOptimizationwithDependencies.ana

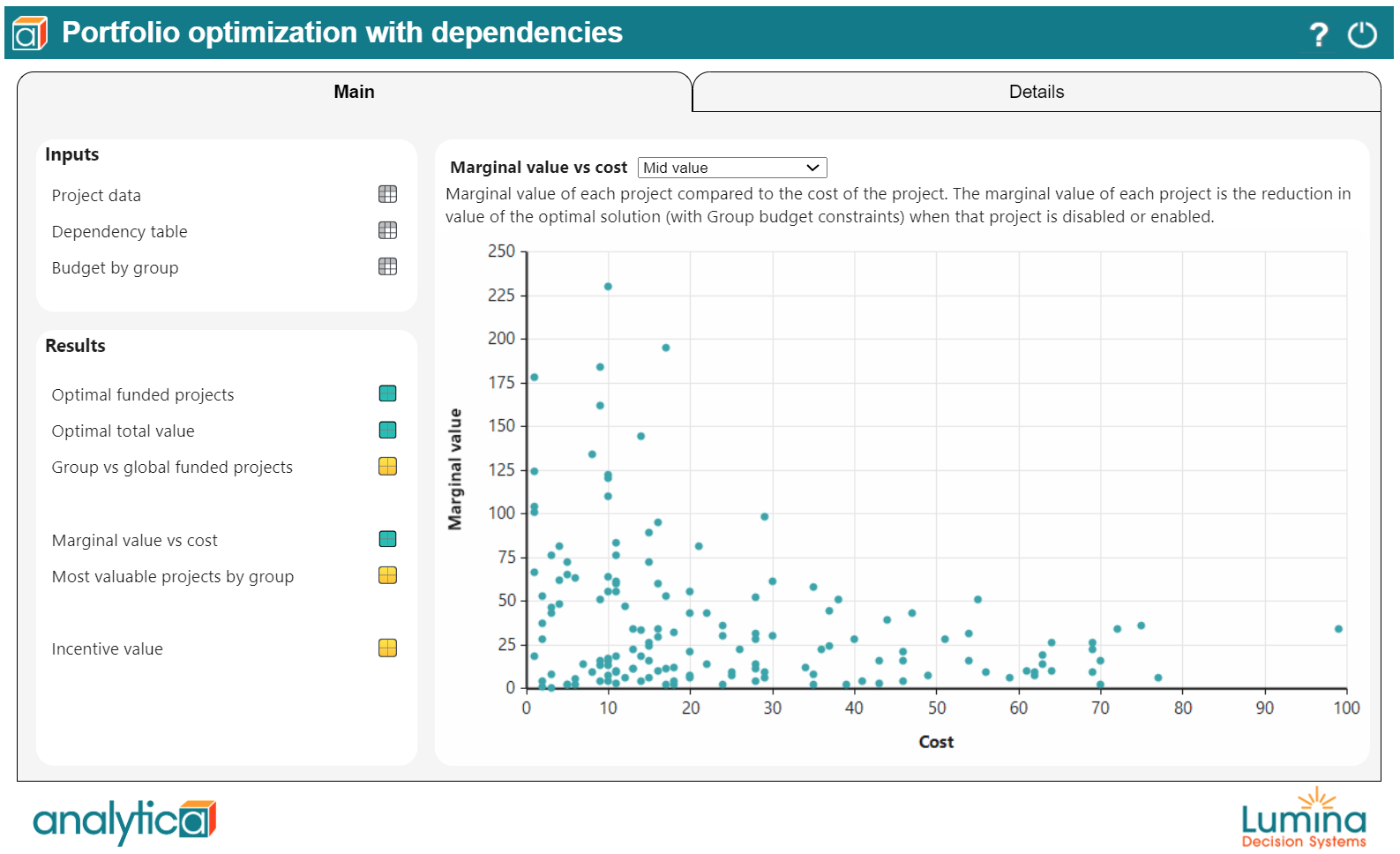

Description: This model sets up an solves an optimization problem that selects projects to complete subject to the following constraints: each project is assigned to a specific group, and has a cost and a value; each project can be subject to dependencies where the project cannot be completed if enabler projects are also not selected; each group has a budget. The model also shows how the optimally funded projects might change if the group budget constraint is changed to a global budget that is the total of all group budgets. The model also has a Sensitivity analysis module and an Incentive adjustment module containing further analysis.

Th Sensitivity analysis module shows adds a new sensitivity constraint to calculate the marginal value of each project. This constraint re-runs the optimization for each project when that project is excluded if it was included in the optimal solution (in the Group problem) or included if it was originally excluded. The marginal value of each project is the reduction in value of the global solution when that project is disabled or enabled.

The incentive adjustment module calculates an incentive value for each project such that if one adds the incentive value to each project's value, each group will select the optimal solution (in the Group problem) without adding a dependency constraint.

Keywords: Optimization

Author: Karen Lee

Enable comment auto-refresher